Educate, advocate, and activate community capital.

Advancing the local investing movement towards empowerment and equity for all.

Choose your path

Understand what we do and how you can get involved

Our Focus: Community Investment Funds

The best way to keep money flowing within your community is to utilize local investments. That’s where Community Investment Funds (CIFs) come in. These locally controlled funds allow community members to invest and support many local businesses, projects, and initiatives within their own neighborhoods. Through local sourcing, investing, and decision-making, these funds create a direct connection between investors and the economic development they want to see in their community.

Why?

Keep Wealth Local

The majority of local banking institutions have been lost since the 1980s and big box stores capture at least one quarter of every dollar spent locally.

Level the Playing Field

Many people don't think they are able to invest or only invest in faraway businesses or mutual funds. There are options for everyone to become an investor and benefit from the local impacts.

Turn Ideas Into Action

Entrepreneurs continually struggle to find necessary capital - local investing provides a pathway to leverage long-term local customer support.

Educate

The National Coalition for Community Capital provides educational resources and programs to support the local investing movement. This work engages community-determined development while empowering all through local wealth-building.

Instead of relying on Wall Street, venture capitalists, or big banks, community capital is money raised from everyday people—neighbors, local investors, and stakeholders—who want to invest in what they believe in: their own community.

Advocate

The National Coalition for Community Capital recognizes current investment regulations while initiating and supporting legislation that expands opportunities for Americans to engage with community capital.

Instead of relying on Wall Street, venture capitalists, or big banks, community capital is money raised from everyday people—neighbors, local investors, and stakeholders—who want to invest in what they believe in: their own community.

Activate

The National Coalition for Community Capital activates the growing movement of local investing by incubating community investment funds.

Instead of relying on Wall Street, venture capitalists, or big banks, community capital is money raised from everyday people—neighbors, local investors, and stakeholders—who want to invest in what they believe in: their own community.

Our Work

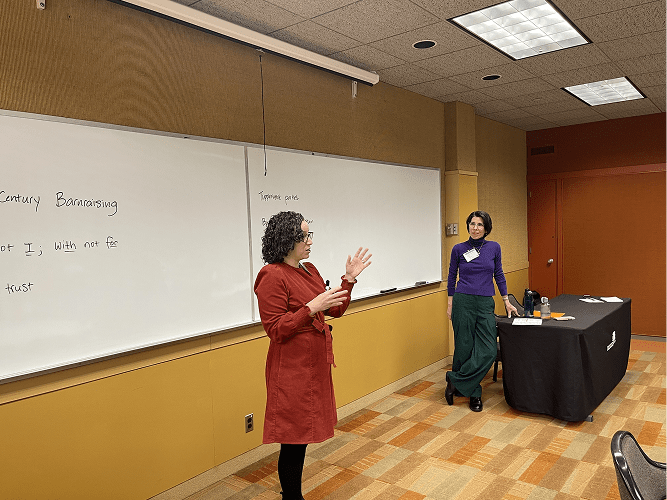

Educate

Kathleen Minogue

Crowdfund Better

“Through collaborative education work, Crowdfund Better® and NC3 are colleagues-in-action. Together we are creating awareness and developing tools to empower local organizations, businesses, and leaders to take charge of what gets made, who makes it, and who benefits.”

Advocate

Chris Miller

NC3

“From the outset, NC3 has advocated for state and federal policy that supports the community capital movement. CEO Chris Miller speaks at the 2025 SEC Small Business Capital Formation Forum about NC3’s Community Investment Fund proposal.”

Activate

Jessica David

Local Return / Rhode Island Community Investment Cooperative

“Without NC3, we would never have launched our offering for the Local Return Diversified Community Investment Fund. Their community investment fund handbook was our original inspiration, and they connected us with important resources that helped us make our vision a reality. We are so grateful for the community of passionate activists and practitioners that NC3 has brought together.”

News

Advocacy Update

NC3’s Policy Committee is working to convene leaders from the community capital ecosystem before the end of the year with

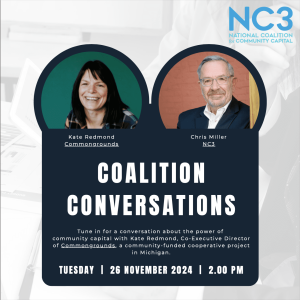

Coalition Conversation: Kate Redmond & Chris Miller

Tune in to our monthly conversations with leaders in the field. NC3’s CEO, Chris Miller, speaks with Kate Redmond, Co-Executive

Event: MEDA’s Economic Development Strategies and Solutions Conference

NC3 will be presenting at two events in Michigan this week. On Thursday, November 7, we will do a keynote

About Us

The National Coalition for Community Capital (NC3) was formed when a small group of passionate community advocates came together around the idea of utilizing local capital to create equitable, inclusive, and resilient local economies.

Now, as a 501(c)(3), we are the national organization offering local investing education and leading community investment fund development.

Factoids

Did you know that Rhode Island has the first Diversified Community Investment Fund in the nation? They are raising $3.5M from everyday people to support real estate projects that create or preserve local ownership of and local benefit from local infrastructure.

According to the SEC, an accredited investor has individual income at $250K or $300k jointly with spouse in each of the prior two years, and networth of $1M (excluding primary residence). We should update these to reflect the correct numbers and add a source citation to SEC Rule 501(a) of Regulation D.

The United States used to have 14,000 community banks. Today we have 4,000. We used to have 1M independent retailers. Today we have fewer than 600k. A big box store moving into town means a 4% fall in brick-and-mortar retail and an increase of 3 percentage points in the annual likelihood of a brick-and-mortar closing.